On 2 June 2025, Roblon signed a declaration of intent regarding the divestment of the Group’s US subsidiary, Roblon US via a Management Buyout by current Vice President of Sales Jamey Little and Finance Manager Melissa Curtis.

The decision to divest the subsidiary was made as a result of a significant deterioration of demand and the competitive situation over an extended period of time.

The closing date of the divestment is expected to be within one to two months.

Roblon A/S will sell Roblon US Inc. for a cash price of USD 1. Roblon A/S will keep one share in the company, which will confer special rights, such as the right to a certain share of distributed dividends.

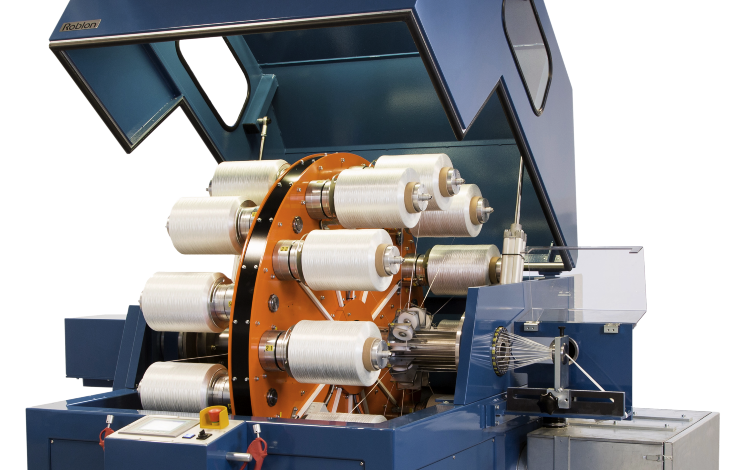

Following the divestment of the US subsidiary, Roblon’s activities will in the coming years focus on the development of products and services for Roblon’s primary markets, comprising the EMEA region and selected overseas customers and customer leads. The Group’s defined primary market is growing, boosted by the current and future expansion of international digitalisation and energy grid infrastructure.

Consequences of the divestment is described in the full company announcement (HERE)

Based on realised results for the first half of 2024/25 and the current order book at the end of April of approx. DKKm 85, most of which is scheduled for delivery in the second half of 2024/25, Management upgrades its full-year guidance as follows:

revenue in the range of DKKm 220-250 against the previously guided range of DKKm 210-240

operating profit before depreciation, amortisation and impairment (EBITDA) and before special items in the range of DKKm 40-50 against the previously guided range of DKKm 30-40

operating profit (EBIT) before special items in the range of DKKm 26-36 against the previously guided range of DKKm 16-26

Additional information can be found in the full company announcement (HERE)