Roblon enhances focus on the Industrial Fiber business segment

In the autumn of 2016, the Group announced a five-year strategy plan for the two business segments, Industrial Fiber and Engineering. In 2016/17, the Group took a number of strategic initiatives, including the acquisition and establishment of a business in the USA in the Industrial Fiber segment, in which the Group identified additional market opportunities in the same period. To strengthen the footprint and expansion of Industrial Fiber, Roblon has today concluded an agreement to sell the largest part of the Engineering segment to Erhvervsinvest and the management of Roblon Engineering, Lars Munch Antonsen and Jesper Krarup Nielsen. According to the agreement, closing of the transaction will take place on 14 March 2018.

The divestment will release management resources and capital to be invested in the future core business.

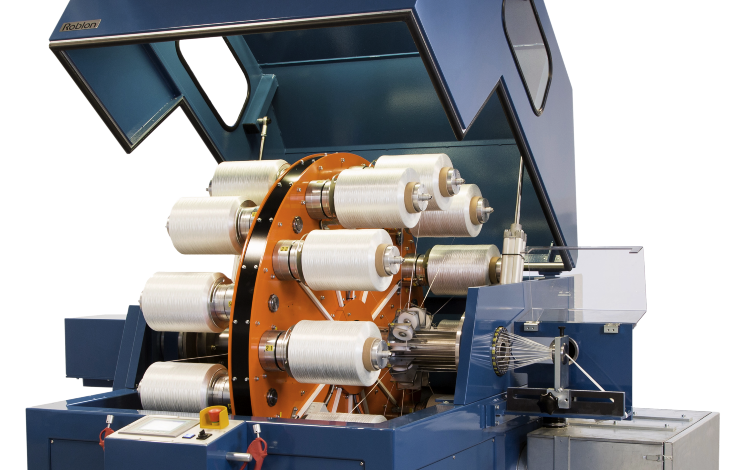

The largest part of Roblon Engineering comprises sale and production of rope-making equipment, twisters and winders, an area in which the Group has over the years built a strong brand, respected in the rope-making industry. Roblon is considered a market leader in the rope-making industry. Of Roblon Engineering's total 2016/17 revenue of DKKm 100.2, this part’s revenue amounted to DKKm 85.9 and segment assets at 31 October 2017 amounted to DKKm 76.5.

Management sees strategic advantages in maintaining the Group’s ownership of the other, smaller part of Roblon Engineering, comprising sale and production of production equipment to the fiber optic cable industry. Moreover, Roblon will focus on being the sole provider in the world offering both production equipment and cable materials to manufacturers of fiber optic cables. This industry has grown rapidly over the past few years and is expected to continue to do so in the years ahead. Of Roblon Engineering's total 2016/17 revenue of DKKm 100,2, this part’s revenue amounted to DKKm 14.3.

As part of the transaction, the buyer will take over all business activities related to sale and production of rope-making equipment, twisters and winders. The buyer will also take over net assets related to the sold operations, including buildings in Sæby, Denmark, technical plant and working capital. All 57 employees will be employed by the buyer. Moreover, the parties have concluded an agreement on sourcing of cable machinery and administrative service agreements during a transitional period.

The new owner intends to further develop the acquired business and consolidate its market-leading position in the ropemaking industry.

The selling price payable to Roblon on a debt-free basis is DKKm 64, and Roblon expects net proceeds from the sale after transaction costs in the DKKm 10 range, which amount will be recognised in profit from discontinued operations.

Management guidance for 2017/18

On 19 December 2017, Roblon issued a company announcement on guidance for the financial year 2017/18. In it, Management forecasted revenue of around DKKm 330 and profit before tax of around DKKm 33. As a consequence of the sale announced above, Management forecasts revenue for the continuing operations of around DKKm 235 (2016/17, adjusted: DKKm 198.6) and a profit before tax from continuing operations of around DKKm 25 (2016/17, adjusted: DKKm 23.4). The profit guidance for 2017/18 is impacted by overhead costs of around DKKm 6 that were previously allocated to and included in the profit of the divested part of the business. This cost base will be maintained for purposes of supporting the Group’s growth and executing the strategy for the continuing operations.