Roblon A/S expands US business

The Roblon Group signs three-year project contract for delivery of fiber-based products for the wind turbine industry

The Group today signed an agreement to acquire assets from Neptco Inc., Hickory, North Carolina, which is part of the listed US Chase Corporation Group.

In April 2017, Roblon acquired business operations related to the fiber optic cable industry from the Chase Group. In order to complete the acquisition, Roblon A/S established a US company, Roblon US Inc., Hickory, North Carolina.

Roblon US Inc. is now making additional investments in production plant, licences and inventory for the production of fiberbased products for the wind turbine industry and has signed a three-year project contract with Ria Blades, owned by Germany-based wind turbine manufacturer Senvion. Under the contract, Roblon will supply parts for the Senvion Group’s rotor blade production with potential revenue over the three-year contract period of up to USDm 15-20. The contract provides an option for extension beyond the three years.

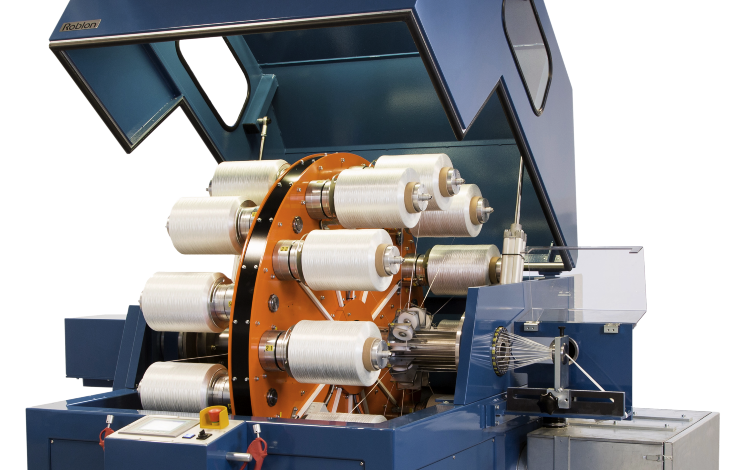

The acquisition of additional, complementary production capacity and the signing of the contract with the Senvion Group were made possible by Roblon’s establishment in the USA in 2017. Parts of Roblon’s existing production capacity as well as the newly acquired production plant relate to production technology for special fiber-based solutions that target the fiber optic cable industry, but can also be applied in other industries – in this instance the wind turbine industry.

A preliminary calculation of the acquisition price is USDm 2.1, with subsequent adjustment for inventory counted as of closing of the transaction, April 20, 2018. For 2017/18, Roblon expects revenue from the acquisition of these activities to contribute some DKKm 20 to the Group’s revenue. After transaction costs, the acquisition is expected to lift profit before tax for 2017/18 by approximately DKKm 3.

Management guidance for 2017/18

For the 2017/18 financial year, revenue from continuing operations is expected to increase from the previously forecasted level of DKKm 235 to DKKm 255 and profit before tax is expected to increase from the previously forecasted level of DKKm 25 to DKKm 28.